Table Of Content

Savings accounts are governed by Federal Reserve Regulation D, which may limit certain types of withdrawals/transfers to six per month. If you go over that limit with multiple ACH transfers from savings to another bank, you could be hit with an excess withdrawal penalty. And if frequent transfers from savings become routine, the bank may convert your savings account to a checking account. ACH transfers are usually quick, often free, and can be more user-friendly than writing a check or paying a bill with a credit or debit card. People often use quitclaim deeds to release unrecorded interest in real property, clear a cloud affecting title to the property, or release one spouse’s interest in real property to the other spouse.

Accredited Automated Clearing House Professional (AAP): Overview - Investopedia

Accredited Automated Clearing House Professional (AAP): Overview.

Posted: Tue, 26 Sep 2023 07:00:00 GMT [source]

Civil Discovery Fees and Services

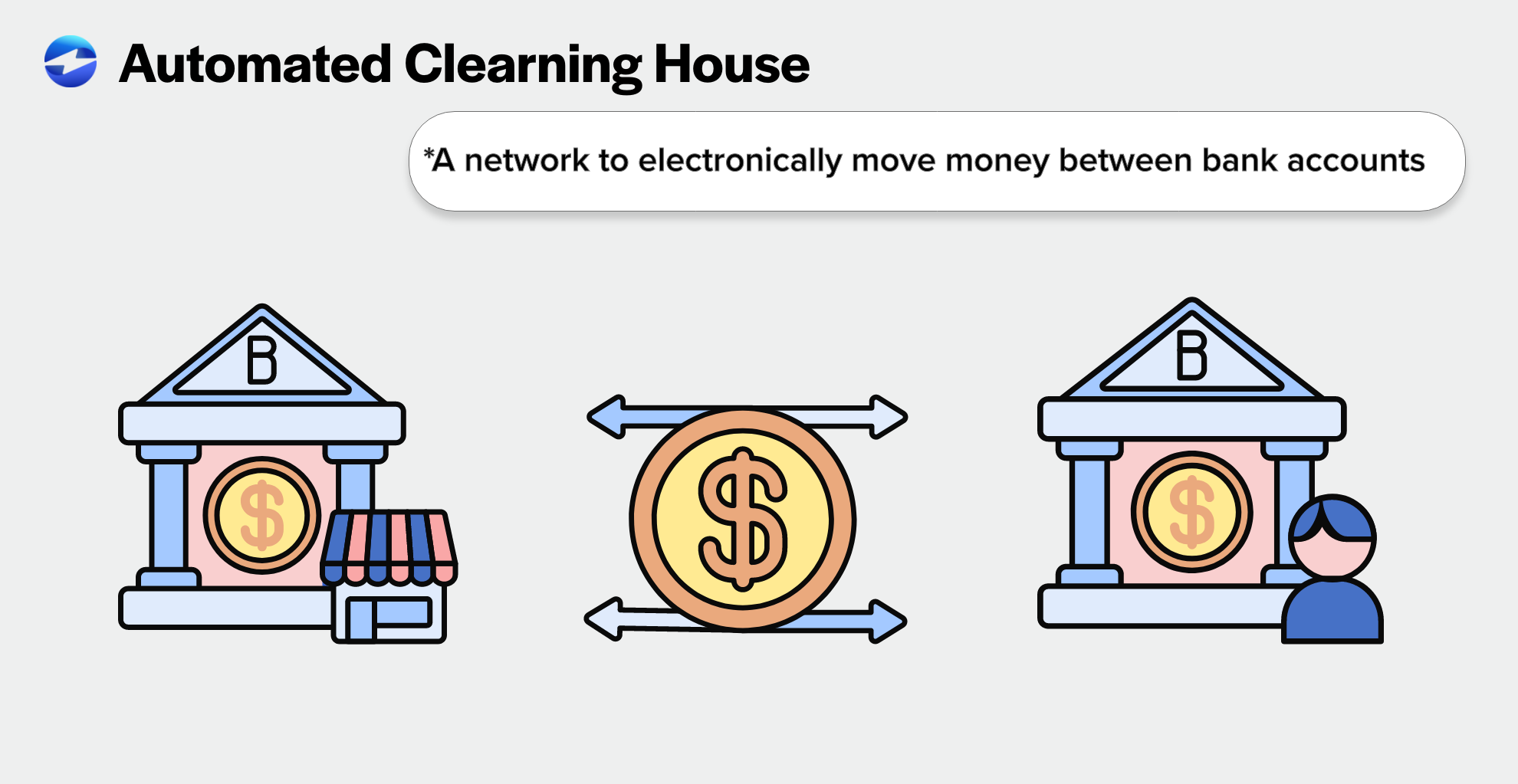

An automated clearing house (ACH) is a computer-based electronic network for processing transactions,[1] usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits.[2][3] The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low value payments. The legal framework for institutions offering payment services is complex. There are rules for large-value payments that are distinct from retail payments.

Potential downsides to ACH Transfers

However, people tend not to use quitclaim deeds when transferring ownership with an exchange of money or sale of property. A grantor may use a quitclaim deed for the transfer of real property in California for an unrecorded or recorded interest. Furthermore, the grantor may only have a “potential” interest in the property at hand. In other words, they may or may not be named on an earlier recorded deed. With a quitclaim deed, the grantor transfers property to the grantee without any warranties or guarantees. A grant deed transfers an owner’s interest in the property and shows the percentage of interest transferred.

Copyright Services and Fees

The ACH Network serves an array of financial institutions with a total value of more than $40 trillion per year through electronic transactions. ACH is used for all kinds of fund transfer transactions, including direct deposit of paychecks and monthly debits for routine payments. Merchants often enable consumers to pay bills via ACH by providing an account number and bank routing number. A number of online payment services also conduct transactions via ACH, including most banks and credit unions’ online bill payment services. An ACH transfer is an electronic money transfer between banks or credit unions through the Automated Clearing House network.

What are ACH payments?

Plus, we can facilitate recording the new deed with the correct county recorder’s office for a much lower fee than hiring an attorney. After selecting the appropriate property deed, the grantor must make a decision about the form of title the new property owners will hold. The most common ways to hold title to real property include as a sole owner, tenants-in-common with other owners, a trustee of a trust, joint tenants, community property, or community property with the right of survivorship.

ACH direct payments are the "pushing" of money from one account to another. Afterwards, the recipient's bank account receives the transaction, reconciling both accounts and completing the process. Using an ACH transfer to pay bills or make person-to-person payments offers several advantages, starting with convenience. Use our convenient transfer tax calculator to help approximate the transfer tax based on the sales price and location of your real property in California. The use of a transfer-on-death deed is limited and is not available for all types of property.

What is an ACH Transfer?

ACH payments are transfers of funds between accounts at different financial institutions, using the ACH network. This means ACH payments may need more time to transfer between accounts. But since March 2018, same-day ACH payments have become more widely available. And in 2021, the ACH network processed 604 million same-day ACH transfers. Governed by NACHA (National Automated Clearing House Association) since 1974, this network enables ACH transactions with direct deposit, payroll, consumer bills, tax refunds, tax payments, and other payment services in the U.S.

Certain banks limit the amount of money you can transfer through the system, so if you want to transfer large amounts of money to other people, you may have to do so through multiple transactions. An Automated Clearing House or ACH transaction is an electronic transaction that requires a debit from an originating bank and a credit to a receiving bank. Transactions go through a clearinghouse that batches and sends them to the recipient's bank. Transactions usually are executed on the same day as long as they are done before 5 p.m. This network manages, develops, and administers the rules surrounding electronic payments.

Wells Fargo customer loses funds in mystery business account transaction - WKMG News 6 & ClickOrlando

Wells Fargo customer loses funds in mystery business account transaction.

Posted: Wed, 01 Nov 2023 07:00:00 GMT [source]

Business Services and Fees

ACH transfers allow for safe money transfers online, such as for direct deposits or bill paying. The Automated Clearing House network, also known as ACH, is a channel run by the National Automated Clearing House Association (NACHA), which transfers funds electronically from one place to another. The NACHA operates to facilitate the growth of electronic payments throughout the US for payroll, direct deposit, consumer bills, tax payments, and more. Most consumers use ACH to pay bills and send money person-to-person payments because it is free for the standard transfer for a duration of 1 to 3 days in the US. Banks and third-party apps such as Venmo, PayPal, and Zelle rely on ACH to move money between friends and family or, in some cases, pay bills.

Microdeposits are very small amounts of money (usually a few cents) that are sent to a bank account and then pulled back using the ACH network, to verify the account details before any real transactions are attempted. Types of ACH transactions include payroll and other direct deposits, tax refunds, consumer bills, tax payments, and many more payment services in the U.S. and internationally. You can also use Zelle, a payment app that works directly with hundreds of banks and credit unions. Zelle delivers money to the recipient right away and the transfer is finalized later through normal ACH processing or in real time if the bank uses the RTP network, a real-time payment system. If the individual or business currently uses paper checks, ACH transfers may be recommended, as it is convenient, easier to process, and environmentally friendly because the payment is completed online.

The RDFI, despite having “receiving” in its name, is not always the bank that receives the ACH payment funds—it receives a request to initiate funds transfer via the ACH network. The ODFI, the institution where the request for funds originates, often receives the money in the end. Think of “originating” and “receiving” in reference to the ACH request, not the funds themselves. Getting paid via direct deposit can be more convenient than being handed a paper check. With direct deposit, you know roughly when funds will hit your bank account and when they’ll be available.

No comments:

Post a Comment